Application For Property Tax Relief Nc 2025

Application For Property Tax Relief Nc 2025. Exclusion applications (click here for copy) must be filed by june 1st. If a married couple is the sole owner of a property, only one application is required.

Application filing period is jan. If a married couple is the sole owner of a property, only one application is required.

Expectations Range From Granting 'Industry Status' To The.

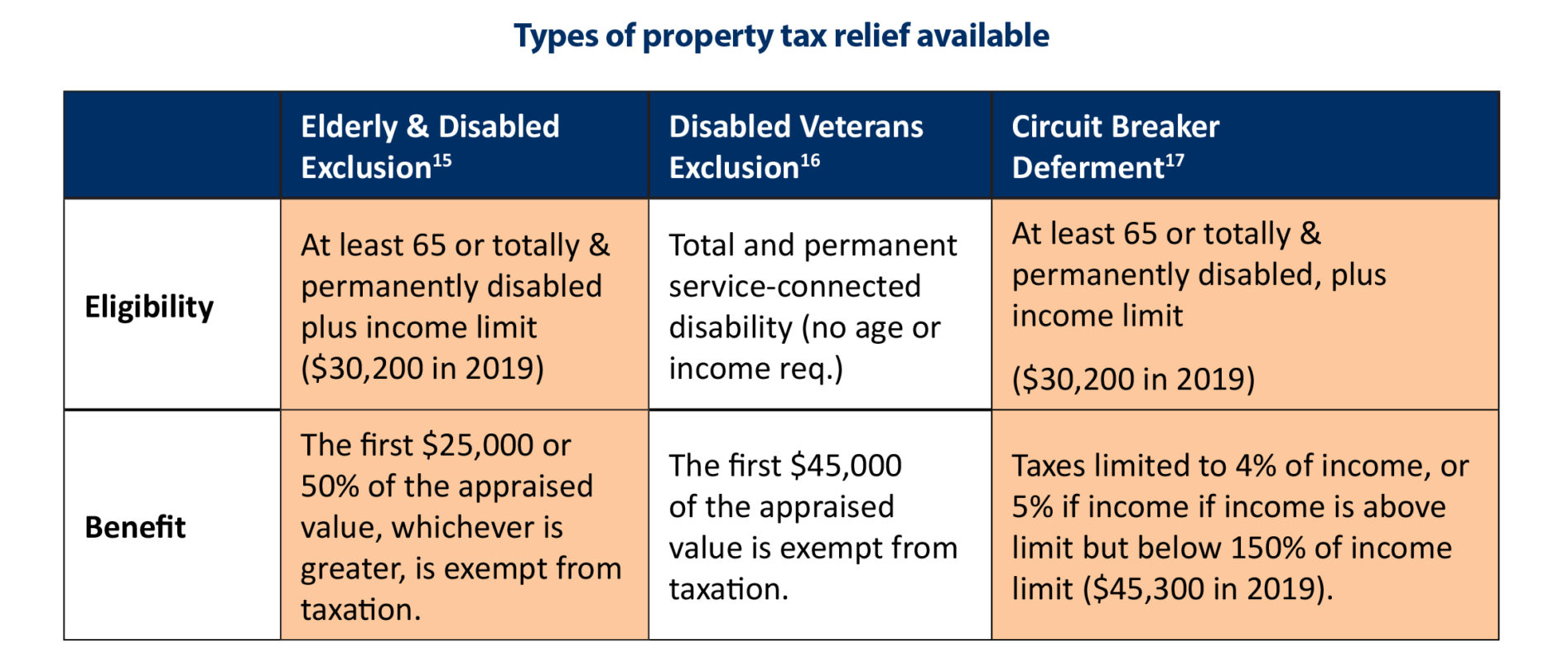

North carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by north carolina residents who are at least.

If Multiple, Unmarried Owners Are Seeking Tax Relief For The Same Property, Separate.

Application for elderly/disabled, disabled veteran, and circuit breaker homestead exclusions:

Application For Property Tax Relief Nc 2025 Images References :

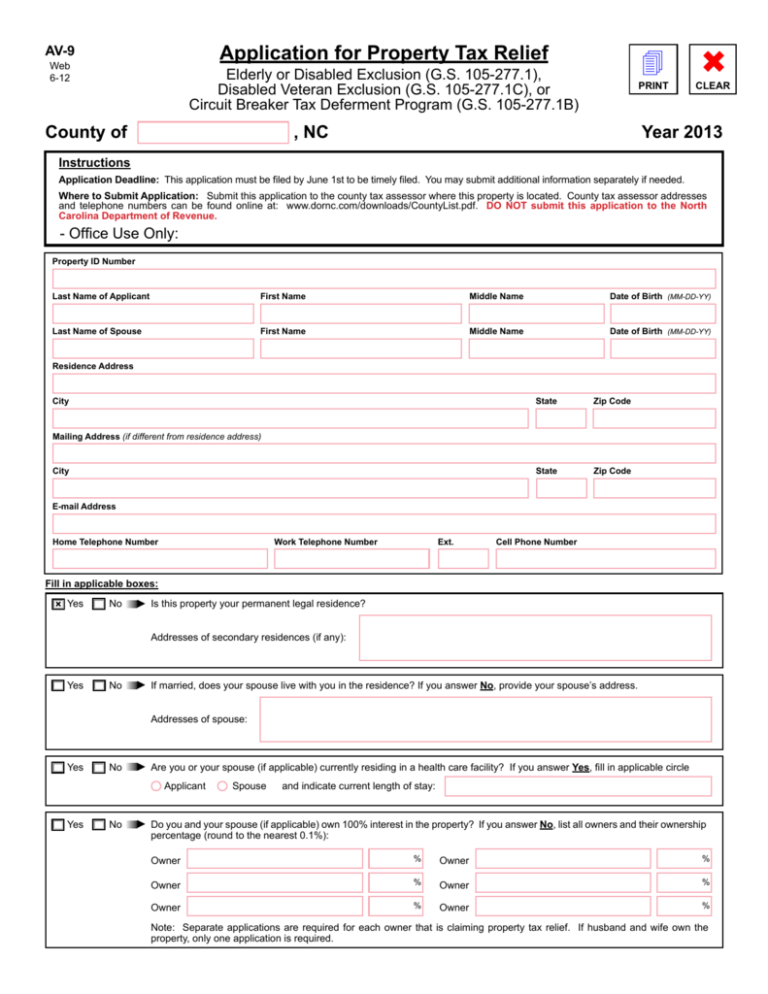

Source: studylib.net

Source: studylib.net

Application for Property Tax Relief, If a married couple is the sole owner of a property, only one application is required. Applications are accepted from january 1 to june 1 of each year.

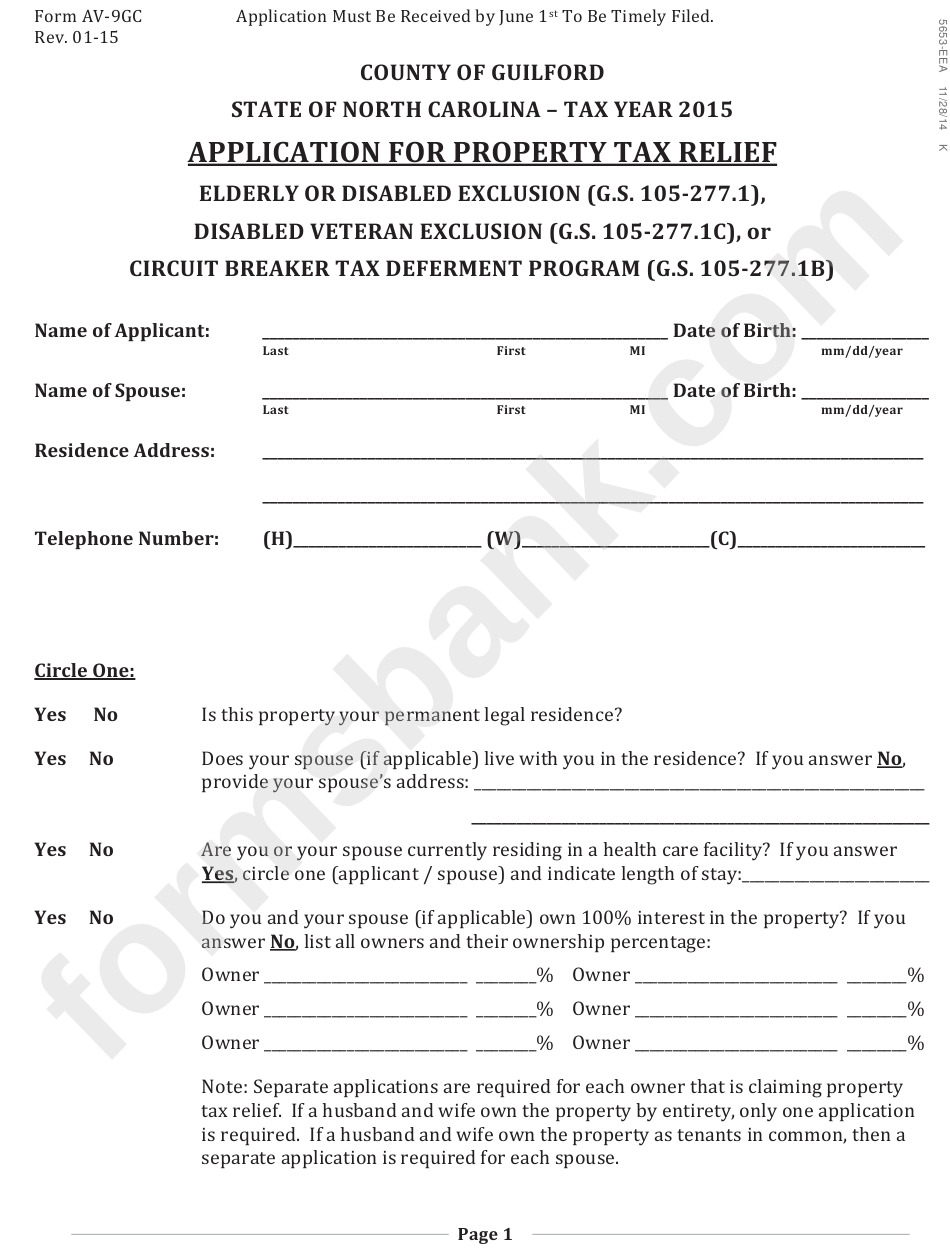

Source: www.formsbank.com

Source: www.formsbank.com

Form Av9gc Application For Property Tax Relief printable pdf download, You will need to submit an application to your local tax office. If husband and wife own the property, only one application is required.

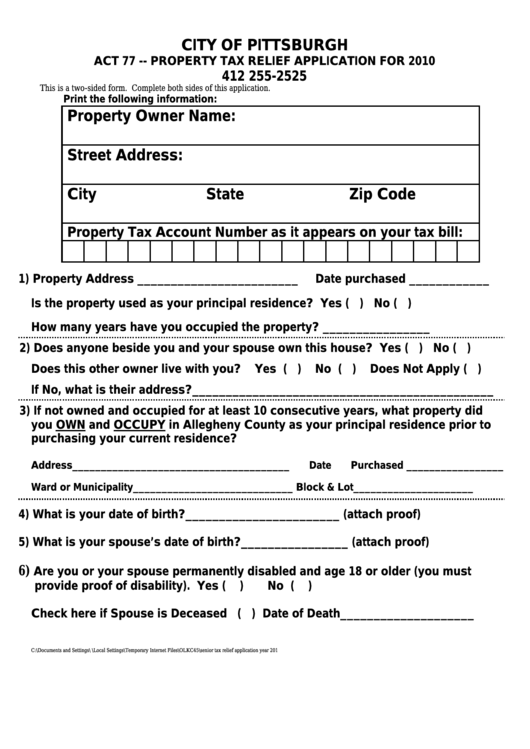

Source: fill.io

Source: fill.io

Fill Application for Property Tax Relief, Applications are accepted from january 1 to june 1 of each year. The tax administration office anticipates starting the next property reappraisal process in the fall of 2025.

Source: fill.io

Source: fill.io

Fill Free fillable Application for Property Tax Relief (Cherokee, To learn more about the income, age, disability, and other requirements for the exemption programs, visit. Separate applications are required for each owner that is claiming property tax relief.

Source: printableformsfree.com

Source: printableformsfree.com

Fillable Application Real Estate Tax Relief City Of Hampton Form, The owner of property who wishes to obtain an exclusion must complete the application for property tax relief for the program they are applying for. If a husband and wife own the property as tenants by the entirety, only one application is.

Source: optimataxrelief.com

Source: optimataxrelief.com

An Overview of Property Taxes Optima Tax Relief, The application should be submitted. Property owners will receive notices of their updated valuation in early.

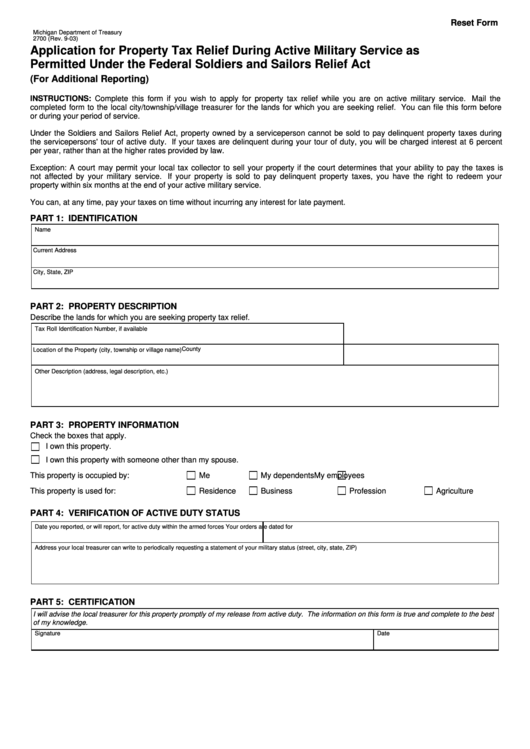

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Form 2700 L4169 Application For Property Tax Relief During, You can find the application for property tax. Application filing period is jan.

Source: fill.io

Source: fill.io

Fill Application for Property Tax Relief, Property owners will receive notices of their updated valuation in early. Separate applications are required for each owner that is claiming property tax relief.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online Fillable APPLICATION Property Tax Relief for, Free viewers are required for some of the attached. You will need to submit an application to your local tax office.

Source: www.ncjustice.org

Source: www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities, Take the form to your local veteran’s service office for certification. If multiple, unmarried owners are seeking tax relief for the same property, separate.

North Carolina Offers Three Property Tax Relief Programs For The Permanent Residence Of Qualified Homeowners.

You will need to submit an application to your local tax office.

This Provision Would Offer Tax Relief On Profits Earned From Developing And Building Affordable Housing Projects, Singh Said.

If a husband and wife own the property as tenants by the entirety, only one application is.

Category: 2025